Today's High Demand Represents the True Demand for Homes

The real estate market is hot right now, and it is still going to increase in value during the coming year. For property investors, it is too early to sell off real estate investments. A recent analysis by the Cromford Report shows the additional growth potential in the Phoenix market. Demand has returned to normal levels, but the supply of homes has not increased enough to match it.

The Results of the Cromford Report

The Cromford Report is owned and produced by a group called Cromford Associates. It is managed by Mike Orr and based out of Mesa. Mike Orr holds a master's degree from the University of Oxford. Over the course of his 31 years of experience in the computer industry, he has worked for organizations like IBM, the Santa Cruz Operation and Tarantella. He began investing in real estate back in 1976.

As the Cromford Report shows, Greater Phoenix has enjoyed a steady increase in sales prices over the last nine years. There is no indication that the market is slowing down. Right now, the Phoenix market is still 5 percent below the point where the market peaked more than a decade ago.

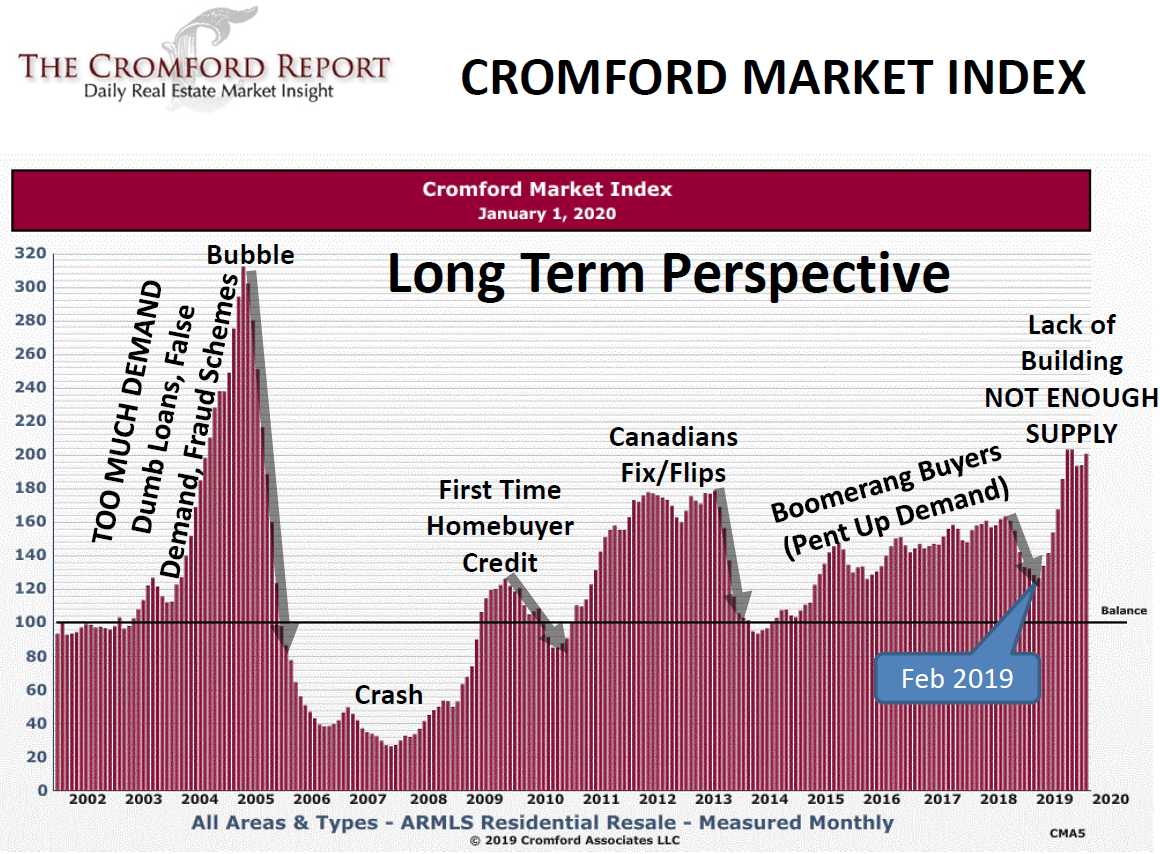

Basically, the marketplace has had to get over a major hiccup that was caused by the buyers' frenzy of the 2000s and the resulting mortgage crisis. This buyers' frenzy created a false sense of demand that drove up real estate prices. Now, the market is experiencing true demand. If you sell your property today, you will end up missing out on potential profits as the market continues to rise.

The Home Supply Is at Rock Bottom

One of the main ways that economists and market analysts forecast future demand is by looking at the supply of homes. Months of supply is a term that represents how many months it would take for the current inventory of homes to actually sell at the current pace of home sales. The months of supply is generally considered a good indicator of where the real estate market is headed. It also shows if the market favors buyers or sellers.

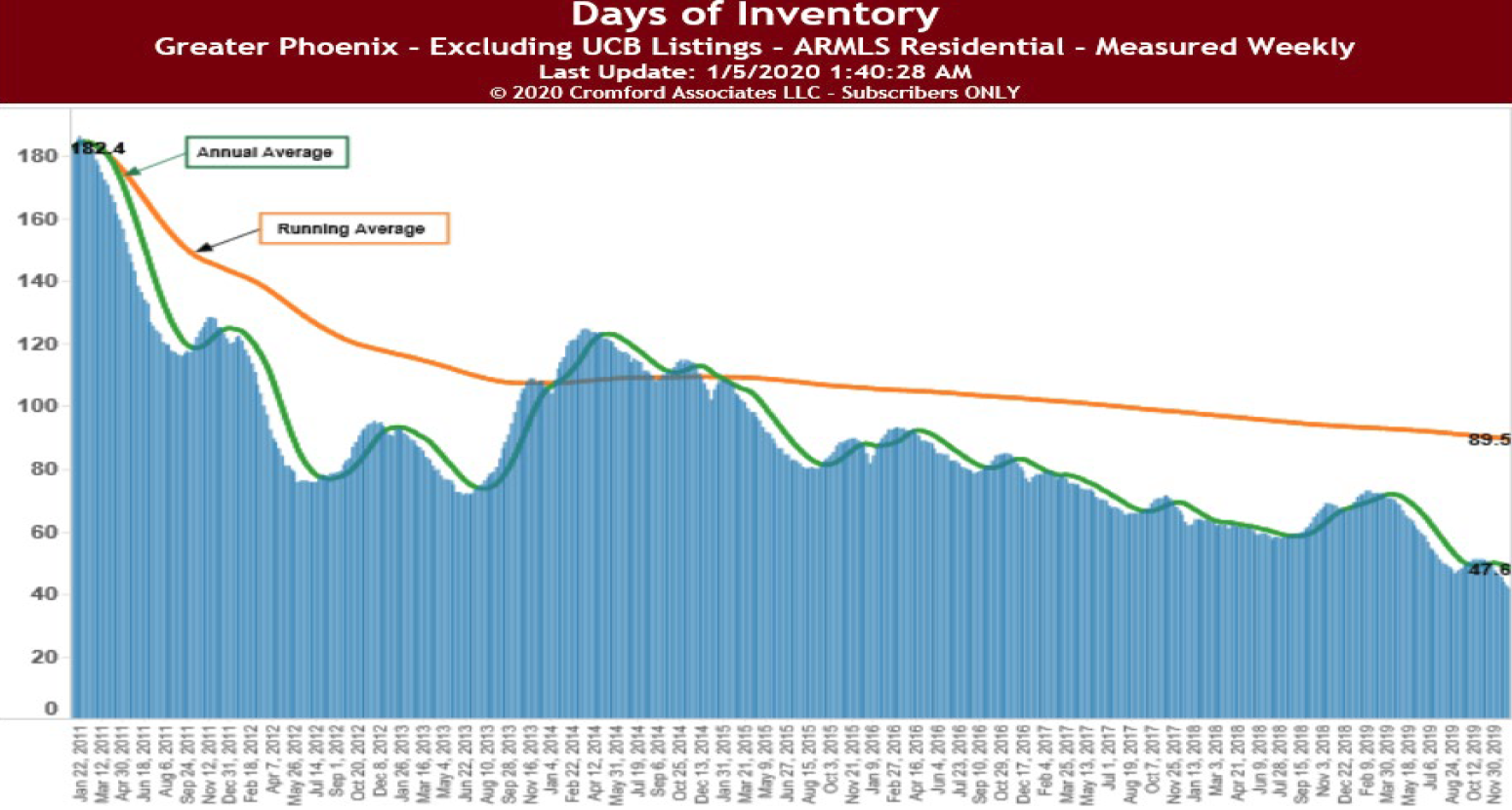

Back in 2011, there was a 182-day supply of homes. This meant that there was roughly a six-month supply of homes in Greater Phoenix. For Phoenix, a normal market has a four-month to five-month supply of homes.

Right now, there is a 47-day supply of homes. This means that all of the homes in Phoenix would be sold in just 47 days if there were no additional homes listed on the marketplace. The area has a low, dwindling supply of homes, which has caused prices to increase. The increased prices you see today are not because of a sudden frenzy of purchases. We are seeing Phoenix's true demand for homes as consumers return to the marketplace following the recession.

It takes time for the housing supply to readjust and meet consumer demand. With a 47-day supply, you can expect the area's home prices to continue to increase. If you sell a property today, you will miss out on an additional profit.

How the Markets Have Changed for the Last 15 Years

The Cromford Report shows another way of considering what the area has experienced over the last 15 years. If you look at the last 15 years of market growth, you can see each correction. Demand falsely increased in 2004 and 2005 because of bad loans, false demand and fraud schemes. After the crash, it grew incrementally because of a first-time homebuyer credit and Canadian house flippers. Now, boomerang buyers have returned to the marketplace. Demand has increased, but developers have not made enough new homes to satisfy this demand.

Because the marketplace is not satisfying demand, it is unlikely prices will drop this year. Prices will continue to increase especially the following factors in place: household incomes continue to grow, housing affordability and mortgage rates must remain neutral. We will look at these factors in our next article.

In Phoenix, the supply of homes is half of the normal level. Demand is at a normal level. This mismatch between supply and demand is why prices are continuing to grow. These factors mean property owners can expect their investment to increase in value if they hold onto it for longer. Until the supply of homes increases, prices will continue to go up.

We love discussing this with our current and potential owners and investors. If you have any questions about how this could impact your investment property or property management in Phoenix, please feel free to contact us at Service Star Realty!

Service Star Realty

1525 N Granite Reef #16, Scottsdale, AZ 85257

(480) 426-9696