Cromford Market Update - Oct/Nov 2020

While the restaurant industry has been hit hard by COVID-19, rental properties have grown in value. Right now, the demand for homes is up 36 percent. Rental prices have increased by 17 percent since April. Since rental prices are still increasing, it is important that property owners do not get scared into selling their units. People always need a place to live, and housing demand in Phoenix is continuing to increase.

Phoenix Real Estate Remains Strong

There may be a number of unknowns in the upcoming year, but it is safe to say that the Phoenix real estate market is not going to crash or suffer major issues in the near future. The new and resale housing markets change slowly, so there would be plenty of advance warning of any problems. This is because real estate is fundamentally different than the stock market. While you can record the price of a stock immediately after you sell it, it can take more than 45 days to go from marketing a home to actually recording the price.

Instead of showing any signs of a problem, market demand has remained strong. Part of the reason why Phoenix performs so well is that supply is limited. For the last six years, the dwindling home supply has caused prices to appreciate rapidly. Normally, the Arizona Regional MLS has 25,000 to 30,000 listings at this point in time. On November 9, 2020, there were just 8,600 listings.

Meanwhile, the number of listings under contract is normally at 9,000 to 10,000. Instead, there are 13,000 listings under contract. Even if this high demand drops in the future, the supply of homes is still lower than normal. Homes cannot be constructed overnight, so prices will continue to appreciate. The only question is how fast prices will appreciate.

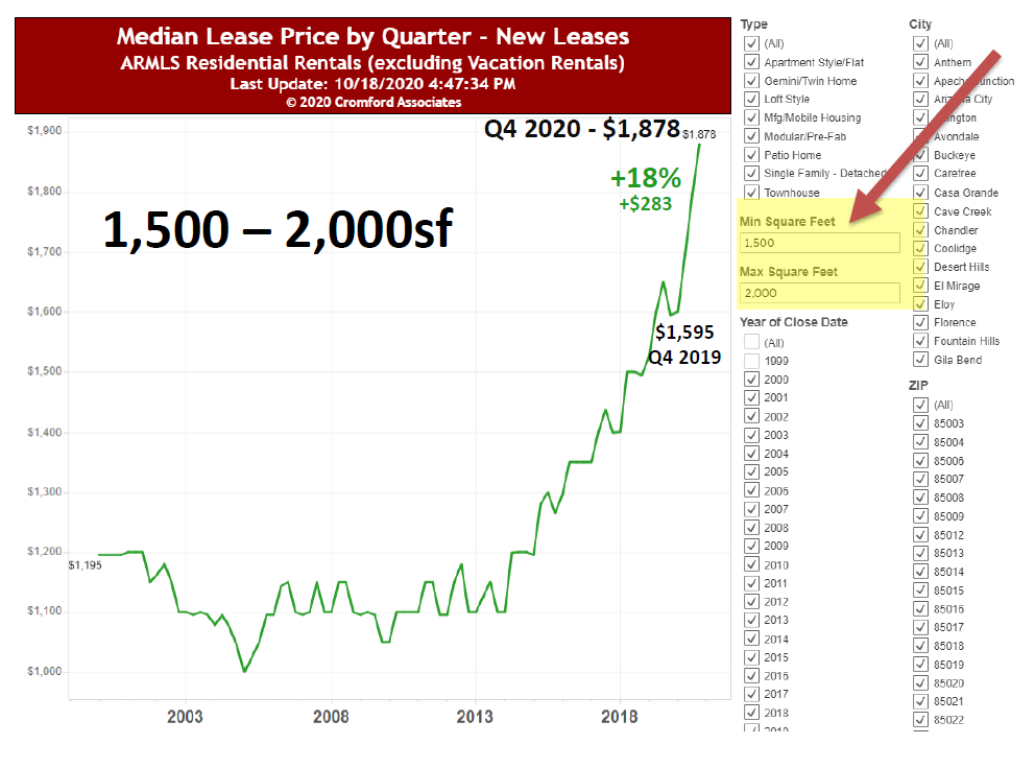

Landlords Continue to Earn High Rental Prices

As a Phoenix property management company, we have watched as rental prices increased for many of our property owners. Since the last quarter of 2019, the rental price of a 1,500-square-foot to 2,000-square-foot unit has increased by 18 percent. The price has increased by $283 from $1,595 to $1,878.

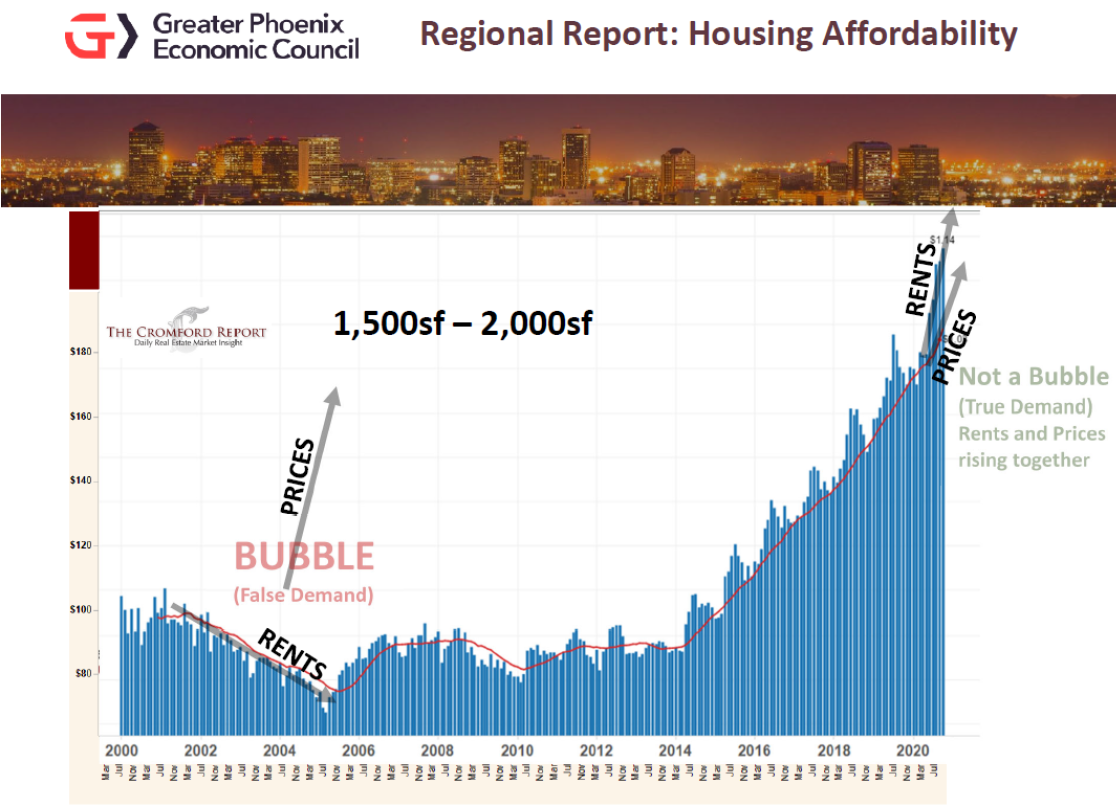

What this means is that we are not going to crash or suffer from a major drop in prices. Phoenix is not dealing with a bubble right now. Demand for rental units remains strong, and the supply of housing is low.

This fact is clearly demonstrated in the regional report on housing affordability from the Greater Phoenix Economic Council. Before a housing bubble, home prices go up. At the same time, rental prices remain the same. Right now, home prices and rental prices are both going up. This means that what we are experiencing is true demand and not a bubble.

Interestingly, the market does not show a shift toward a balanced market. When we have a balance between a buyer's and seller's market, prices do not drop, but will start to rise at a slower rate. As we haven't started to shift out of a Seller's market Prices continue to appreciate rapidly, so property owners can comfortably let their properties appreciate in value.

Is Migration Affecting the Housing Market?

Back in 2000, developers built too many new homes. These new constructions ultimately led to the crash of 2008. In the last decade, the real estate market has recovered. While affordability was at a normal level in the second quarter of 2020, a pandemic-related surge in demand has caused prices to appreciate at a faster rate than before.

For homeowners, interest rates make housing prices fairly stable right now. In comparison, rental prices are rising quickly. Because analysts expect prices to continue increasing, they recommend that buyers purchase a home now before prices increase even more. While buyers are rushing to buy homes before they appreciate in value, sellers can relax and enjoy the appreciation.

Part of the continued demand for homes is from migration out of California. While the 2020 census should show the extent of this migration when it eventually comes out, Service Star Realty has seen some of these changes firsthand. As long as there are more buyers moving here and purchasing homes, prices will continue to appreciate. Compared to October 2019, houses are appreciating at a rate of 19.2 percent. If you use annual sales, appreciation is still at an impressive 10.5 percent.

There are other changes going on in the rest of the economy right now as well. Unemployment is up slightly at a level of 6.7 percent. Compared to previous downturns, this increase is fairly low. When you consider that the state's unemployment rate has a long-term average of 6.26 percent, this is a very reasonable level.

No matter what changes happen in the overall marketplace, Service Star Realty is here to help out our property owners. Thankfully, the upcoming year looks bright for real estate and rental prices. With an increase in demand and a lack of supply, prices will continue to grow in the near future. Like always, our team will be here to analyze the marketplace and support our property owners. Contact us if you would like to discuss how your property is performing.

Check back often for more blogs and other market updates.

https://www.leaseaz.com/blog/how-to-scale-your-residential-real-estate-portfolio-in-phoenix-az

Service Star Realty

1525 N Granite Reef #16, Scottsdale, AZ 85257

(480) 426-9696